Welcome to the Physicians Life Income Plan!

Meeting ID: 836 7929 7891

Passcode: 453339

Join us for a short zoom call to discuss the plan as well as how to get started with it. This will be a short 15 minute zoom each month but the host will stick around and answer questions if anyone attending would like.

How to get started!

Schedule a one on one call with the head of the program Jason Hiser

You can also reach out directly to Jason Hiser.

Jason@fsgllp.com

Direct – 847-275-0645

Features and Benefits:

- Accumulation-focused plan design

- High early cash surrender values

- No income contribution limits

- No direct surrender charges

- More than 80 investment options

- Investment discretion

- No required minimum distributions

- Tax-free transfers

- Tax-free rebalancing

- Tax-free distributions

- Tax-free death benefit to beneficiaries

- Asset protection in NY and many states

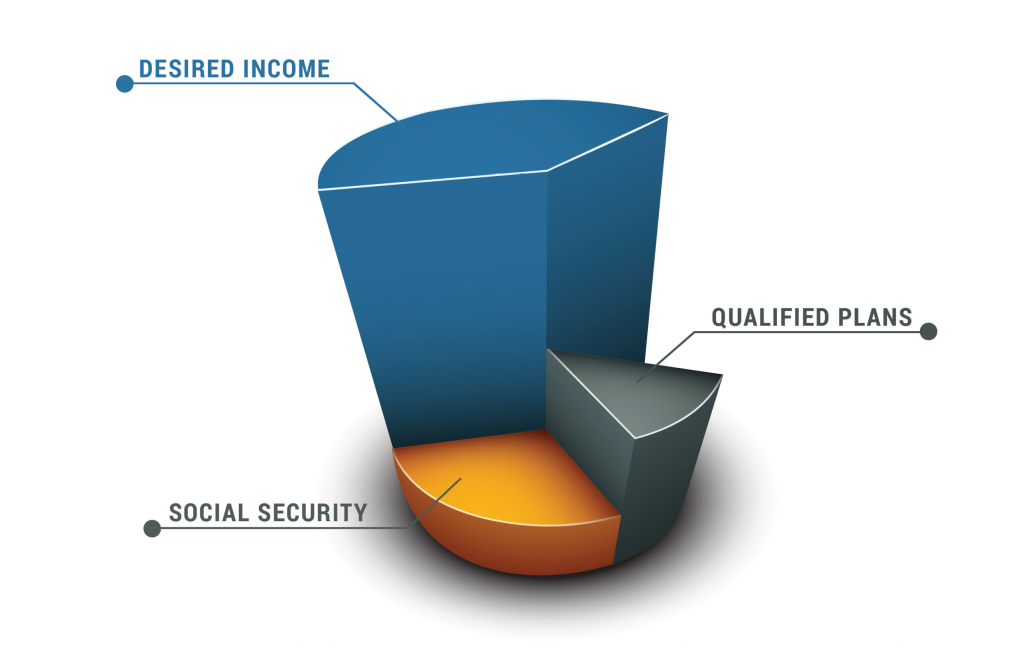

The Retirement Gap

How the Life Income PlanSM Works

Implementation

- Pay initial Premium

- Targets 97-107% of 1st year cash surrender values based on market performance and other factors

- Initial Policy Sub-Account allocation

Accumulate

- Pay Annual Premiums as structured

- Investment options in the form of Sub Accounts

- Tax-Advantaged

Manage

- Automated Annual Review Provided

- Policy sub-account allocation rebalancing

- Risk Tolerance changes

- Tax-Favorable access to cash values*

- Quarterly Sub-Account monitoring/scoring

- Policy Sub-Account allocation guidance

Distribute

- Tax-Advantaged Distribution Options through

Policy Withdrawals and Loans* - No pre-59½ Early Access or Withdrawal Penalty

Mortality

- Tax-Free Death Benefit

* Loans and withdrawals reduce the policy’s cash value and death benefit, and withdrawals in excess of the policy’s basis are taxable. Under current rules, loans are free of income tax as long as the policy remains in effect until the insured’s death, at which time the loan(s) will be satisfied from income-tax-free death benefit proceeds, and, if the policy is surrendered, any loan balance will generally be viewed as distributed and taxable.

Imagine...

For a moment, imagine the IRS changed the rules, allowing physicians the chance to invest in a Roth IRA without any contribution or earned income limits.

Would you be Interested?

How much would you want to invest?

Although that change is highly unlikely, PLIP has engineered tax and accumulation advantaged strategies that can help alleviate the challenges facing physicians, like:

- Limited pretax contributions by ERISA plan designs

- Accessibility limits to qualified assets prior to age 59½

- Required minimum distributions at age 72

- Phase-out provisions based on income for post-tax Roth IRAs

Let PLIP put you on the path of income planning and financial freedom.

Asset

location

is key

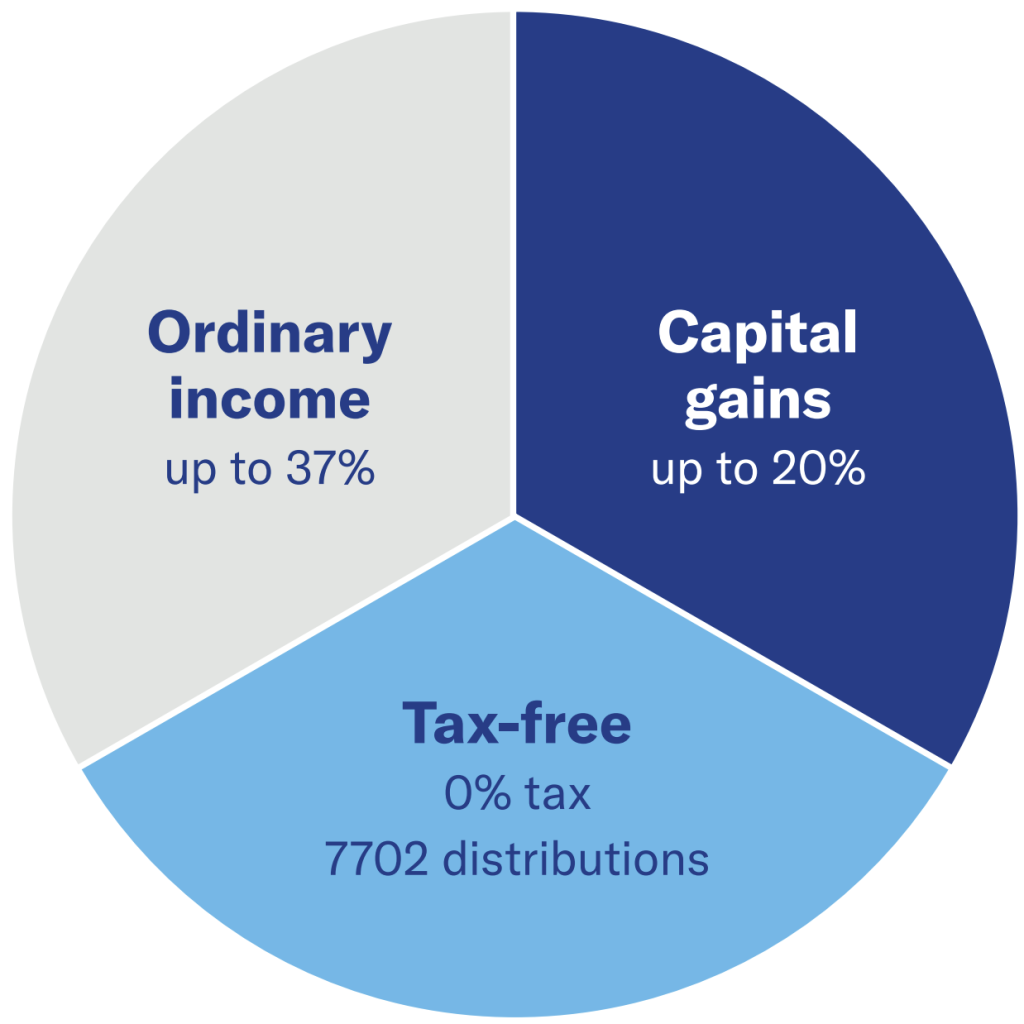

Asset location

Asset location refers to the different tax locations of

portfolio holdings and tax treatment when you withdraw your asset.

Without asset location planning

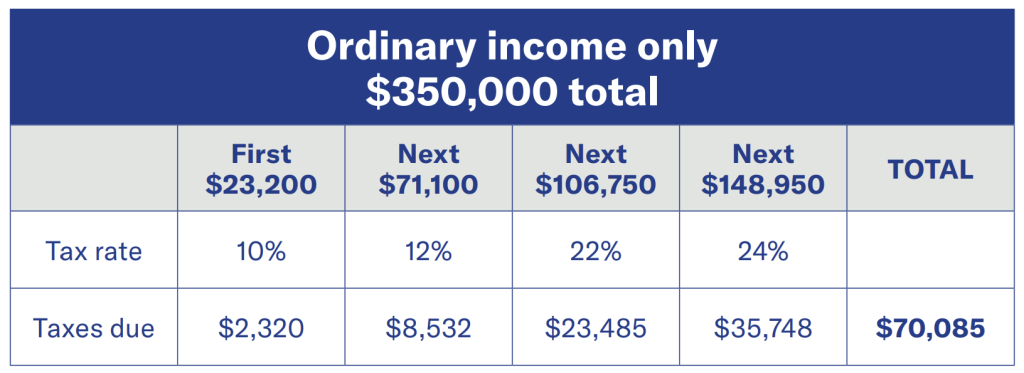

Let’s take a look at an example. The Smiths just retired and need to pull $350,000 from their investments this year to maintain their lifestyle. If the Smiths had never done an asset location plan, they may not have been investing in all three locations during their working years, which means they may only be able to pull their retirement income from one location, the ordinary income location, which is typically a 401(k). In this case, they would end up paying $70,085 in taxes, based on current tax treatment.

Effective tax rate = 20%

With asset location planning

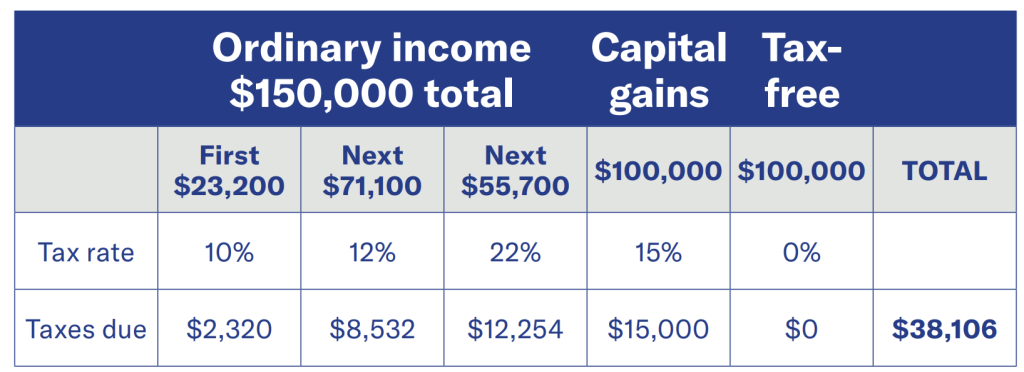

In option 2, the Smiths met with a financial professional and, based on their asset location plan, determined an optimal mix of investment locations. Since they had been investing in all three locations, they have the option to pull their $350,000 from all three locations. In this case, they can take $150,000 from the ordinary income location, $100,000 from the capital gains location, and $100,000 from the tax-free location.

Effective tax rate = 10.9%

Total tax savings with asset location planning =

$31,979 (45.6%)

By determining their tax rates, finding the ideal tax locations and applying tax bracket planning, the Smiths were able to reduce their effective tax rate from 20% to 10.9%, a total of $31,979.

Of course, this is just a hypothetical example — with your personalized asset location plan, you’ll be able to determine how best to potentially reduce your taxes based on your income and investments.